Stop Leaving Money on the Table: How Grocers Can Maximize Hiring Tax Credits

Co-authored by FMS Solutions and Canary Hiring Technologies

(Canary has acquired 321Forms and HR Screening Services to deliver a fully integrated, end-to-end hiring and tax credit platform.)

Independent grocers are facing more pressure than ever. Between rising labor costs, shrinking margins, and fierce competition from national chains, every dollar matters. But here’s the hidden opportunity: most grocers are missing out on thousands of dollars in hiring tax incentives

each year—often without realizing it.

That’s why FMS Solutions and Canary Hiring Technologies have partnered to help grocers unlock these hidden savings through automation, insight, and zero-hassle implementation.

That’s why FMS Solutions and Canary Hiring Technologies have partnered to help grocers unlock these hidden savings through automation, insight, and zero-hassle implementation.

What Are Hiring Tax Incentives—and Why Should Grocers Care?

The best-known hiring tax credit is the Work Opportunity Tax Credit (WOTC)—a federal program that rewards businesses for hiring individuals from certain target groups, including veterans, long-term unemployed individuals, and SNAP recipients.

For grocers, that can mean $2,400 to $9,600 per eligible new hire—a significant amount that directly reduces your federal tax liability.

But WOTC is just the beginning.

There are more than 1,000 local and state tax credit and incentive programs available

across the U.S. each year, including:

- State enterprise zone hiring credits

- Workforce development and training incentives

- Location-based and economic development incentives

- Small business employment subsidies

These programs can generate tens or even hundreds of thousands of dollars in additional savings—but most grocers aren’t taking advantage of them because they’re difficult to track, apply for, and manage.

Why Grocers Are Missing Out

Even large chains miss these incentives for three key reasons:

- Lack of awareness: Many grocers simply haven’t heard of these programs or don’t think they qualify.

- Red tape: Manually applying for WOTC or state/local credits involves complex paperwork, short deadlines, and frequent follow-up.

- Limited time: With lean HR teams, grocers rarely have capacity to chase down tax incentives.

FMS + Canary: Automating the Process, Maximizing the Return

FMS Solutions provides decades of trusted financial guidance to independent grocers. Canary Hiring Technologies delivers the tech muscle—using AI-powered automation to help businesses capture every single eligible dollar in hiring tax credits, from federal WOTC to lesser-known state and local programs.

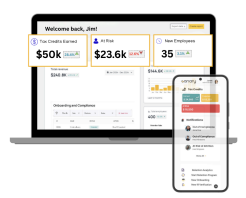

Canary’s platform makes it easy to turn everyday hiring into long-term ROI:

✅ Identifies eligible hires automatically during the application or onboarding process

✅ Submits and tracks all claims—federal, state, and local—with zero paperwork

✅ Surfaces real-time dashboards so you can see exactly how much you’re saving

✅ Costs nothing upfront—no risk, just reward

And here’s the part most grocers miss: the first six months of a new hire are the most critical for retention. That’s when WOTC and other credits are earned. Canary’s platform not only unlocks tax savings—it also gives you insight into hiring trends, retention risks, and workforce quality, all in one place.

A Simple Roadmap for Grocers

If you’re hiring, you’re already doing most of the work. Here’s how to turn it into real savings:

1. Connect with Canary + FMS to estimate how much you may be missing out on

2. Activate WOTC and state incentive screening (in-store or online)

3. Let automation handle the rest—from filings to compliance to tracking

4. Watch your tax credits grow without adding any extra admin work

Real Results from Real Businesses

Tax credits aren’t just a nice idea—they’re real cash back:

- A nationwide manufacturing company earned $600,000+ in credits after expanding into a state enterprise zone

- A 30-store convenience chain now brings in $100,000+ annually

- A small regional supermarket averages $50,000 a year in WOTC savings alone

- A cleaning and maintenance company qualifies over 25% of new hires and earns $35,000+ annually

Stop Leaving Money on the Table

You’re already hiring. Now it’s time to get paid for it.

Let Canary and FMS do the heavy lifting—so you can focus on running your stores.

👉 Book your free demo at www.canaryai.com and discover how hiring tax incentives can start growing your bottom line today.