June 2025 CPI Report: Modest Inflation Growth, Notable Shifts in Food Prices

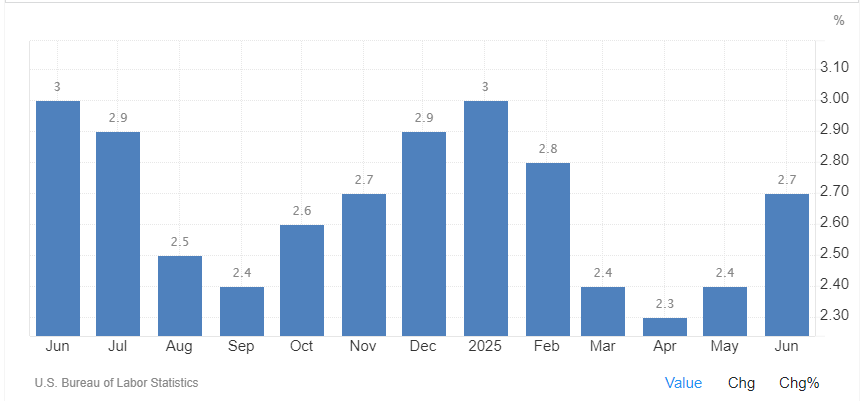

The U.S. Consumer Price Index (CPI) rose 0.3% in June 2025, a slight increase from the 0.1% increase in May, according to the U.S. Bureau of Labor Statistics. Year-over-year, the all-items index climbed 2.7%, suggesting that inflation remains moderate but persistent.

What’s Driving Inflation?

-

Shelter rose 0.2% and remains the largest contributor to overall inflation.

-

Energy prices jumped 0.9% in June, led by a 1.0% increase in gasoline.

-

Food prices increased 0.3%, matching May’s growth.

Food at Home: Mixed Movement

Shoppers saw notable shifts in grocery prices:

-

Nonalcoholic beverages increased 1.4%, with coffee alone rising 2.2%.

-

Fruits and vegetables gained 0.9%, driven by a 2.3% increase in citrus.

-

Other food at home rose 0.2%.

However, declines were seen in:

-

Cereals and bakery products (-0.2%)

-

Meats, poultry, fish, and eggs (-0.1%), with eggs down 7.4%

-

Dairy and related products (-0.3%)

Year-over-Year Highlights

-

Food at home prices rose 2.4% overall.

-

Egg prices remain volatile—despite a monthly drop, they’re still up 27.3% year-over-year.

-

Food away from home climbed 3.8%, with full-service meals up 4.0%.

Grocery Industry Snapshot

According to Anne-Marie Roerink with 210 Analytics, consumer sentiment may be stabilizing, but shoppers continue to make frequent, budget-conscious trips—buying only what they need. While inflation continues to drive dollar growth, unit sales are flat or declining across many departments.

However, meat and dairy stand out as exceptions, showing robust growth in both volume and dollars. In June:

-

Meat department sales reached $8.6 billion, supported by increases in beef, chicken, lamb, and pork. Fresh meat sales increased 3.0%.

-

Yogurt, cottage cheese, and specialty cheeses also showed strength in dairy.

-

Egg prices are trending down, but demand remains strong.

In contrast:

-

Produce growth slowed, especially in vegetables.

-

Baked goods and deli meats remained flat or declined.

-

Seafood showed mixed results: ambient seafood grew, while fresh and frozen saw pressure.

(Source: 210 Analytics)

Why It Matters

For independent grocers, tracking category-level CPI shifts—and pairing them with real-world sales data—helps inform smart decisions on pricing, promotions, and inventory. As shopper behavior evolves in response to inflation and seasonal trends, aligning with consumer needs will be crucial to protecting profitability and driving traffic.